Do you have additional questions about the security of Wave? We’d be happy to tell you more about the many steps we take to ensure the security of your sensitive information. Easily monitor and keep track of what’s going on in your business with the intuitive dashboard. The quick summary allows you to stay in control of your business finances, including a task list of outstanding items.

Manually creating invoices in Microsoft Word or Excel can be time-consuming and difficult to manage. Digital invoicing empowers your small business by automating invoice processing and saving time by tracking key invoice data like upcoming and outstanding invoices. You can also manage late payments more efficiently through e-invoicing by setting up payment reminders to send to your customers before an invoice due date. 1 Payouts are processed in 1-2 business days for credit card payments and 1-7 business days for bank payments.

Accounting software that works as hard as you do

For example, the rate a freelance web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in a different area. With a Wave Pro subscription, you’ll have recurring billing and other automation features. Schedule everything, from invoice creation and invoice sending, to payment collection and overdue payment reminders. The Wave app lets you easily generate and send invoices to your clients wherever and whenever you need to.

Accountant-friendly software

Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada take control of their finances. Developer API Including but not limited to developer.waveapps.com, api.waveapps.com.

Button up your business with professional invoices.

See our step-by-step guide on how to import bookkeeping data into Wave here. Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay. Easily create, fall 2021 reconciliation customize, and send professional invoices while on-the-go. I look at the dashboard and know how many invoices are on the way, when they should be paid, and the average time it takes someone to pay. It keeps me on track and takes a lot out of my hands.

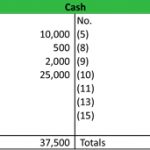

When everything is neatly where it belongs, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices. A common issue when invoicing in Microsoft Word, Excel, or other DIY solutions is making calculation errors. Wave’s invoicing software for small businesses removes the worry of making these errors because calculations are done for you, including the taxes. Every invoice paid means more revenue coming into your small business.

- Visit your dashboard or use your invoicing or accounting features, and click the peach “Upgrade now” button.

- Your customers can pay the invoices you send them instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay.

- Wave is a PCI-DSS Level 1 Service Provider.

- Electronic invoices are created with online invoicing software or other cloud-based services, which makes it easy to automate the invoicing process.

- Connect your bank accounts in seconds with the Pro Plan.

Visit your dashboard or use your invoicing or accounting features, and click the peach “Upgrade now” button. Learn more about changing subscription periods and plan types, and how to cancel your Pro subscription in our Help Centre. Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also set up recurring payments, auto-reminders, and deposit requests to make sure you always get paid on time. Know when an invoice is viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow.

All you need is an Internet connection and a browser! If you’re on-the-go, you can also send invoices from your phone or other mobile device using the Wave app. Get paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable payments. Customers can click a Pay Now button on invoices and pay instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. You can accept credit cards and bank payments for as little as 1%2 per transaction. Set up recurring invoices and automatic credit card payments for your repeat customers and stop chasing payments.

Automate the most tedious parts of bookkeeping and get more time for what you love. Ready to invoice in style, bookkeep less, and get marginal cost formula and calculation paid fast?

Say #sorrynotsorry to your spreadsheets and shoeboxes. See Terms of Service for more information. activity driver Want to look more polished, save more time, and conquer cash flow?